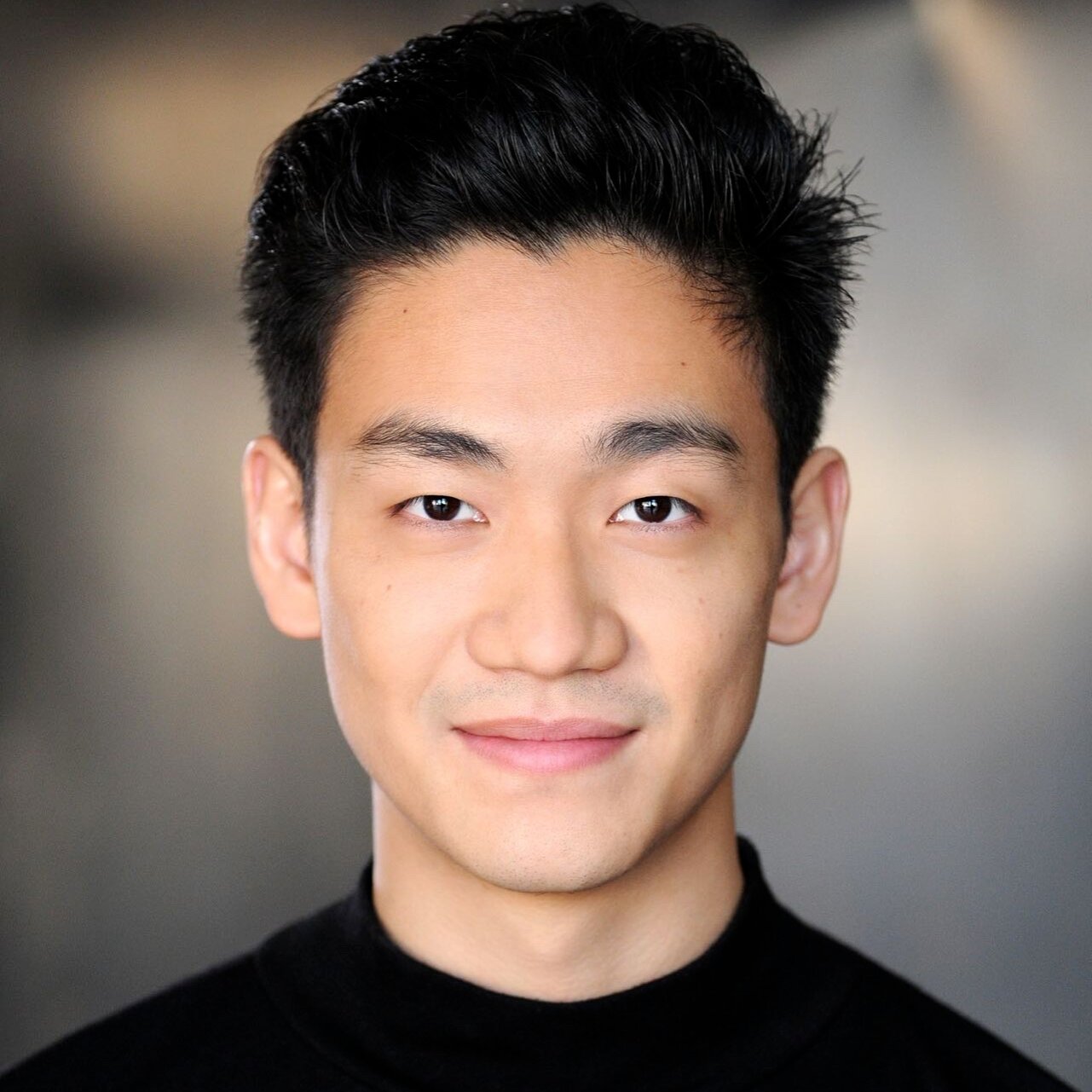

Robinland achieved a very important

milestone on Jan 24, passing the

Greenlight Poll on MakerDAO’s governance forum for its MIP6

collateral onboarding application. After lots

of revisions and hard work, the team was able to overcome the

concerns Maker delegates had brought

forward. This article will give readers an inside look into the

MakerDAO process and the steps we took to

achieve a “yes”.

The Maker Application ProcessMakerDAO

is a decentralized autonomous

organization that can receive applications from any entity around

the world to access its DeFi liquidity

pool contingent on approval based on a pre-defined governance

procedure.

Typically, the

application process involves:

- The applicant submitting

applications to the governance forum

according to Maker’s pre-specified format for the

application.

- The community engages with it during

a cooling off period (usually 2–4 weeks) by posting

questions

- Community Greenlight Poll to

determine which applications to prioritize

- Maker’s ‘Core

Units’ to conduct assessment/verification

of the application along 3 dimensions: commercial, legal and

technology

- Onboarding call where the

applicants present to the community, the community asks questions,

and finalizes with an onboarding poll

to decide whether funds will be dispersed

It was not

the easiest time to navigate the Maker

process, for various reasons Robinland still decided to

apply.

Despite our confidence,

Robinland has been preparing for Maker’s MIP6 application since Q4

2021. Even though we know of cases

where the applicant failed the first time but went back, revised

and succeeded the second or third time,

we wanted to make sure that the first version of our application

is top quality.

As a result,

we

- Studied all of the applications on Maker’s forum that

are relevant to our case

- Talked to

10+ security/real estate/financial lawyers about our legal

structure and any/all regulations related to

the process

- Talked to Matthew Rabinowitz, the architect

behind the 6s capital structure to

understand its rationale and what Maker is mainly looking

for

After a long period of

preparation & revision, we finally submitted our proposal to

Maker’s forum on Nov 21. What’s next was

a 2-week cool down period in which the community engages with the

proposal and asks questions. Over the

next few days, we indeed received a few questions from the

community, and have addressed their concerns

about liquidity of security tokens, Maker’s position as ‘Senior

Secured’, reserve fund, the use of

Polymath jurisdiction accordingly.

Usually, the

greenlight poll happens on each 1st and 3rd

Monday of the month, so ours should be scheduled for 12/20.

However, due to the holiday season, ours was

pushed to 1/10 instead.

After an anxious holiday

season, our team got back and fully prepared

for the greenlight. To our surprise, during the first 3 days, the

‘leading option’ was actually a ‘No’ on

our proposal. Among the voters, 2 delegates voted no, and the

other 4 voted abstain.

Seeing

that, we quickly responded by messaging MakerDAO asking for

feedback, as we’re sure that (1) we’ve drafted

it with all the knowledge collected from other approved proposals

(2) meaning there must have been some

misunderstanding going on about key elements of our proposal (3)

or there are certain reason out of our

control that’s leading delegates to vote no, such as long backlog

or being in the transition period to a

new collateral onboarding model.

At the same time, we

received an extremely valuable piece of

feedback from @MakerMan, a major delegate, on his own delegate

forum. It provided clarity over what the

concerns are, and a chance for us to address them openly to the

entire community. Upon receiving it, the

entire team paused all other engagements and jumped onto the case

and quickly came up with a very detailed

rebuttal, addressing all of the concerns, with the key points

being:

- RBL represents fractions of a

*portfolio* of loans. This brings 2 benefits (1) mutual insurance

among the loans minimizes risk of

default of the overall portfolio (2) rather than issuing

heterogeneous tokens mapping to each underlying

projects which suffer from poor liquidity, we’re issuing a form of

homogeneous tokens that represent the

senior lien commercial real estate asset class, which brings about

much better liquidity.

- The

underlying collaterals are full-recourse right senior lien debt,

which is more secure than any asset we’ve

seen in other real estate MIP6 applications. The senior lien debt

itself is equivalent to the ‘senior

tranche’ in a capital stack MakerMan suggested. (See illustration

for details) The full-recourse right

(again not present in other real estate MIP6 proposals) is the

highest level of protection for real estate

debt projects, as it means the entirety of the value of the loan

can be traced back in the case of

default. If we were to adopt the tranching method MakerMan

suggested, defaults on the ‘first loss’ tranche

can still affect the senior lien.

We provide 3 layers

of protection for Maker:

(1) A put

option for the RBL tokens. (We will keep trying to execute until

Maker’s needs are fully

satisfied)

(2) Full-recourse right provided by the underlying

asset.

(3) Robinland’s industry

connections with a robust secondary market for senior lien

commercial real estate debt buyers, meaning we

can easily sell a loan in our portfolio in 1–2 weeks.

- We

are taking on most of the labor-intensive

steps in the process because we have the right skillset,

experience, and industry connections in our team

to do so. We are alleviating Maker from touching the dirty work

and we are achieving our mission of

serving as a bridge between Trad-Fi and DeFi — as the financial

service provider. We let all the

transformation happen within, such that our partners — real estate

developer & DeFi lenders can stay

within their comfort zone.

- There isn’t a concern over

‘conflict of interest’ as (1) all the

valuation and audit of the loan portfolio is conducted by

industry-standard third party consultancies such

as CBRE, BakerTilly, JLL, and Cushman & Wakefield (2) Role of

the liquidator is purely to execute

steps according to judicial process and state laws and all

documentations and data involved in the process

is out in the public (3) which we are more than happy to let Maker

appoint a third party to take on and/or

let Maker appoint a third party to supervise such process.

-

In fact, Robinland’s role is similar to

an Arranger: we’ve set up a structure that is robust enough to

include a large number of commercial real

estate debt assets, mitigating Maker’s risk as outlined above, and

also saving Maker from labor-intensive

work by taking on that in-house. This means we are a financial

service provider that can serve as the

bridge between Trad-Fi and DeFi specialized in the real estate

industry for the benefit of both parties.

(Project suppliers and liquidity suppliers)

The

rebuttal was a turning point in the Greenlight

voting process, as it:

- Clarified to the community that what

Robinland is proposing is much in line

with what Maker is looking for, both under the current framework

and where it’s headed.

- Showcased

Robinland’s professionalism & flexibility in adapting to major

partners’ needs such as Maker, which is

the key in a healthy long-term partnership in a changing

environment such as RWA X DeFi

From

then onwards, we received positive feedback from many delegates,

and received public support from the

forum. A few days later, we noticed that our voting result had

turned to a ‘Yes’ for its leading option,

with 55k MKR yes, 18k MKR abstain, and 17k MKR no according to the

vote breakdown. This is the best result

among all other applications who are going through the greenlight

poll in the same batch.

We’re

really proud to have passed Maker’s greenlight poll especially

during such a turbulent time. This really

gave us confidence that we’re a team who not only possess the

right expertise to produce a top-level

framework that satisfies specifications of the industry leader

(i.e. Maker), but also the flexibility and

resilience to adapt to challenges and resolve point by point, the

latter of which being the key to success

in such a changing environment.

We also know that this

is not the end, not even the beginning

to the end, but just the end of the beginning. After the

greenlight poll, we’ll be coordinating with

Maker’s Core Units under the RWF division to conduct all necessary

due diligence and assessments. In that

process, if there is anything that does not satisfy Maker’s needs,

we’ll again change and adapt. Even so

and after passing of the onboarding poll, we’ll also keep engaging

with Maker to adapt to its needs and

the overall regulatory environment.